It’s a sudden economic freefall like no other. By some estimates, Massachusetts will have 473,000 COVID-induced job layoffs and furloughs by summer. Most people with jobs won’t make or spend as much in the months ahead. Almost every source of revenue on which the state relies — like income taxes, business taxes, sales taxes, gambling taxes and more — will plunge.

How far could tax collections fall? Potentially, very far — perhaps $5 billion or more below the amount lawmakers were counting on for Fiscal Year 2021. As the Commonwealth scrambles to balance the books and stabilize revenues, it should take steps to shore up revenue for the medium and long-term. The initial focus should be on eliminating tax breaks that benefit the highest-income households and profitable corporations. Our state has thrived because we invest in our people. In this crisis and its aftermath, how we tax will reflect our values more than ever.

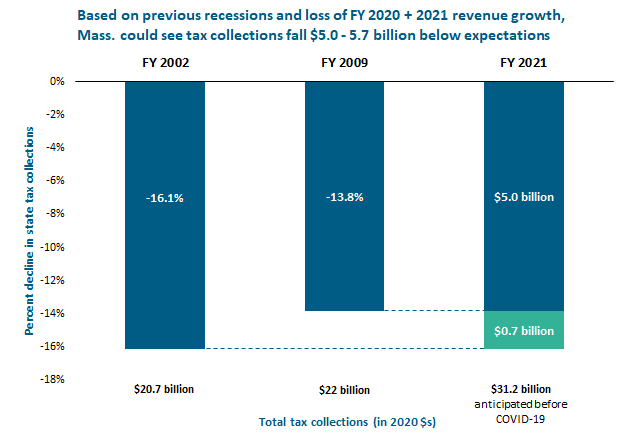

If tax collections in the current recession follow the pattern seen in the last two recessions, we can expect tax revenue to fall off a cliff. In the first year following the start of the last two recessions (so, in Fiscal Year (FY) 2002 and FY2009), Massachusetts state tax collections dropped by 16.1 percent and 13.8 percent respectively, adjusted for inflation. In each previous downturn it took six years after the start of the recession for inflation-adjusted collections to return to their pre-recession levels. Were similar percentage drops to occur at today’s collection levels, the Commonwealth would see a loss of $4.2 billion to $4.8 billion in FY2020. Factoring in the further loss of expected tax growth during the coming fiscal year (which now seems unlikely to materialize), tax collections could fall $5.0 billion to $5.7 billion below the levels lawmakers had been expecting for FY2021.

In its initial rounds of emergency aid, the federal government will deliver some help to the states. The Commonwealth, our municipalities, and transit authorities appear poised to receive about $4 billion in federal aid. The Commonwealth will need more federal funds to respond to the virus and provide support to people left out of federal relief programs. Massachusetts can’t stop investing in its people, especially in those who are most vulnerable.

Soon lawmakers will need to build a budget for the coming fiscal year — which begins in just three months. One option state lawmakers will not have is to run a deficit, as the federal government does. Our state Constitution prohibits borrowing to fund ongoing operations. When tax revenues fall, lawmakers must find other ways to bring the budget back into balance. One way to avoid deep cuts to essential state programs is to reconsider costly tax breaks.

We are fortunate to have $3.5 billion in our Rainy Day Fund. These resources, however, could be dwarfed by the scale of state revenue losses we may see in the months and years ahead. Recognizing this as a possible — or even a likely — scenario, we should act now to place the Commonwealth in a better financial position over the medium to longer-term. We can delay, reduce or eliminate a number of tax breaks, the benefits of which are narrowly focused on the highest-income households and large, profitable corporations — the folks that have taken the lion’s share of income gains over the last several decades. For instance, we could:

- Eliminate, reduce the cost of, and/or delay implementation of a new state charitable deduction that otherwise would go into effect next January. The Governor recommended examining these options in his most recent budget proposal, even before the COVID crisis. Without legislative action, this new tax break will cost the Commonwealth $300 million a year, almost half of which will go to households with incomes over $1 million a year.

- Reduce or eliminate many of the dozens of special interest business tax breaks — together now costing the Commonwealth over $1 billion a year — that have been shown to be both inefficient and ineffective. We should stop giving $180 million a year to mutual fund companies through the single sales factor tax break that this industry responded to by shedding thousands of jobs over the last two decades. Lawmakers must resist the inevitable calls from corporate lobbyists to add to the state’s red ink with new or larger business tax breaks. These tax breaks rarely, if ever, pay for themselves and each lost dollar must be made up elsewhere.

- Following the lead of some dozen other states, we can couple our state tax code to provisions in the federal code to close tax loopholes used by large, profitable multinational corporations. For example, we can recoup as much as $400 million a year by disallowing these corporations, already identified by the federal government, from avoiding their Massachusetts tax obligations through accounting tricks that make profits appear to have been earned offshore.

The next few years will be exceedingly challenging. Lawmakers will face many hard trade-offs as they attempt to address burgeoning needs with dwindling resources. With enough federal aid and prudent use of our Rainy Day Fund — along with proactive policies that increase tax collections and tax fairness — lawmakers can see us through the current crisis and set us on a path to a stronger recovery. Eliminating wasteful tax breaks should be at the center of these efforts.