Read That’s A Relief Part I: Federal Fiscal Relief to Massachusetts in Recently-Passed Legislation here.

The federal Coronavirus Aid, Relief, and Economic Security Act (“CARES Act,” or “C3”), provides substantial federal fiscal relief for the states, benefits to certain businesses, as well as direct payments to individuals suffering hardship due to the pandemic and the subsequent economic disruption.[1]

This funding includes $5 billion total nationally for community development funding, including funding to municipalities for a wide variety of local programs, funding for housing assistance and to prevent homelessness, and more. Listed below are estimated funds from the CARES Act that will be available to local communities. These estimates are based on the most up-to-date information at this time.[2]

$60.7 million estimated boost to Massachusetts for Community Development Block Grants (CDBG).

CDBG funding provides important economic development support for local communities, including housing and public services such as food pantries. There are two types of community development block grants: those that go to larger and more urban communities based on a federal formula (“entitlement grants”)[3]; and funds that the state awards to smaller communities that do not receive entitlement funding directly from the federal government.[4] In Massachusetts, these community development funds have little to no impact on the state’s operating budget as they are distributed directly to cities and towns and local organizations.

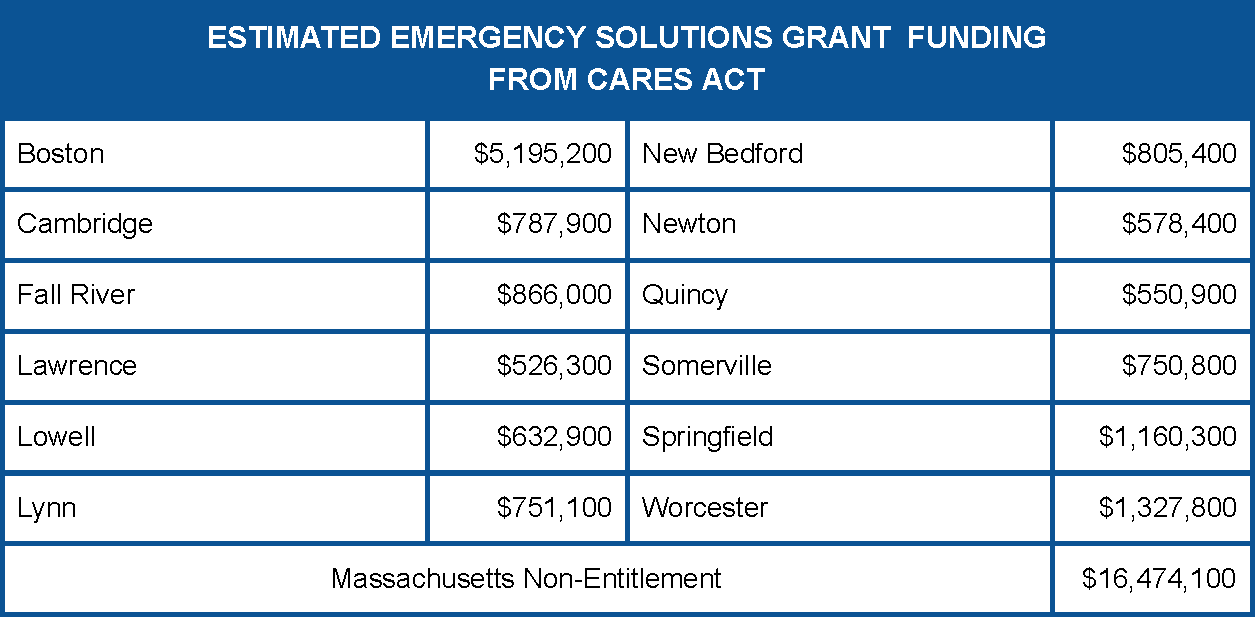

$30.4 million estimated boost to Massachusetts for emergency solutions grants.

The Emergency Solutions Grants are available to municipalities and community-based organizations that provide emergency shelter, financial assistance or other services for households at immediate risk of becoming homeless.[5] People and families that are unstably housed during this pandemic are at particular health risk, and these emergency funds are a critical first step to provide some immediate support.

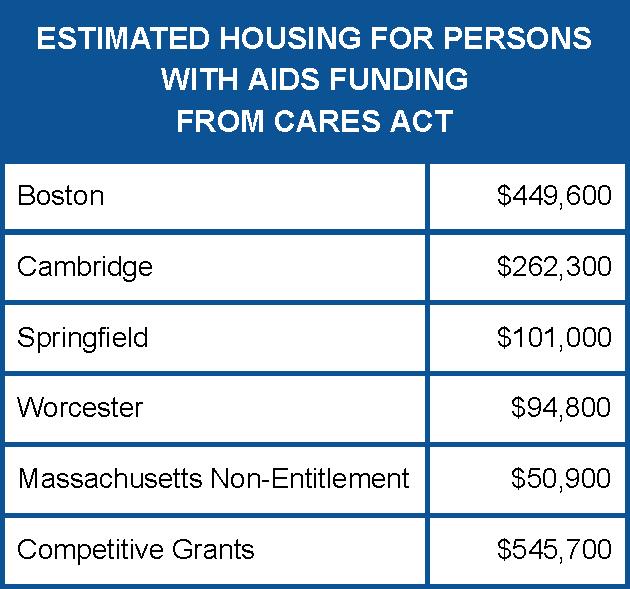

$1.5 million estimated additional funding for Housing for Persons with AIDS

The Housing for Persons with AIDS funding (HOPWA) is available to several communities that receive formula grants to support housing assistance for persons with AIDS. This new funding totalling $959,000 is available to provide rental assistance, housing maintenance, and other supportive services needed to prevent, prepare for, or respond to COVID-19. In addition to this formula funding, $545,700 is available to four Massachusetts non-profit organizations that receive competitive funding from this program.[6]

ENDNOTES

[1] See https://www.congress.gov/bill/116th-congress/house-bill/748?q=%7B%22search%22%3A%5B%22Coronavirus%22%5D%7D&s=3&r=3 and also https://crsreports.congress.gov/product/pdf/IN/IN11315

[2] See funding allocations here https://www.hud.gov/sites/dfiles/CPD/documents/fy2020-CARES-allocations-AllGrantees.xlsx

[5]https://www.hudexchange.info/programs/esg/

[6]https://www.hudexchange.info/news/cares-act-supplemental-award-information-for-hopwa-grantees/