For more information, view the presentation slides here.

***

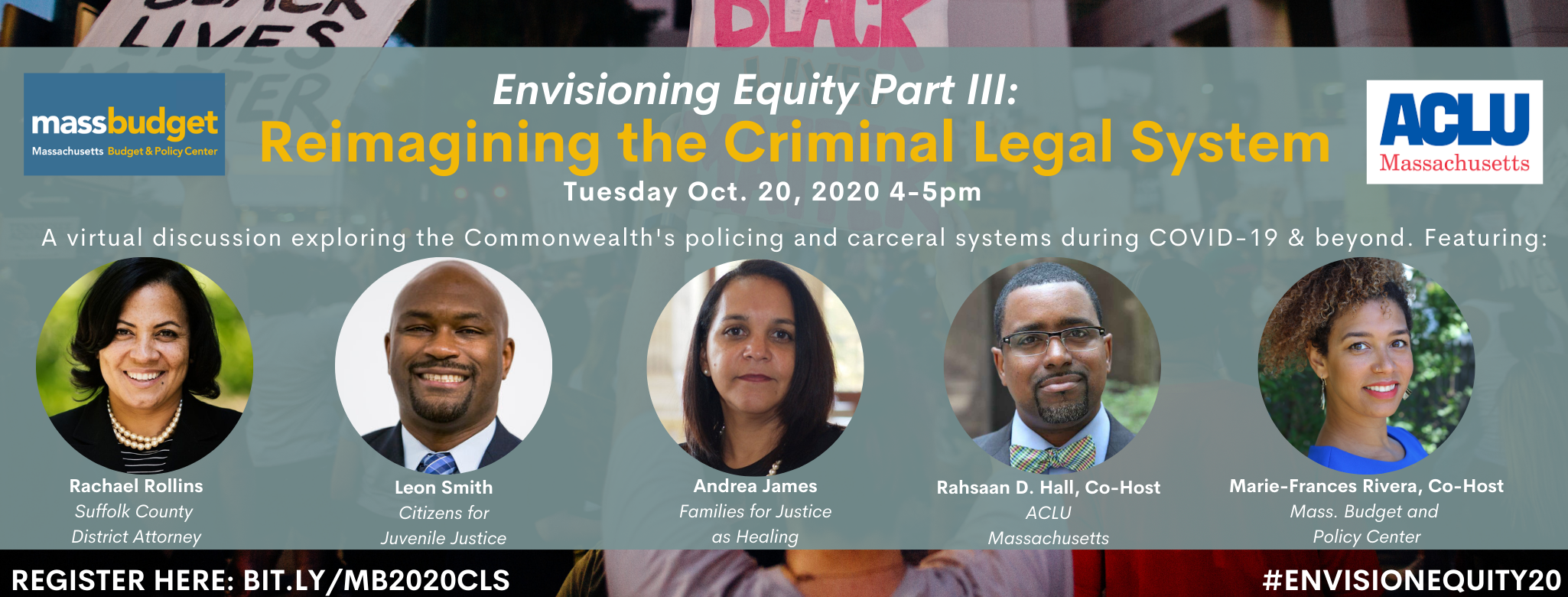

The Envisioning Equity Series:

Fall 2020 – MassBudget hosted a series of community conversations examining how our state budget can help build economic and racial justice in Massachusetts. The three sessions looked at K-12 education (Sept 22), housing (Oct 6) and the criminal legal system (Oct 20).