Photo via Getty Images

Photo via Getty Images

Friend,

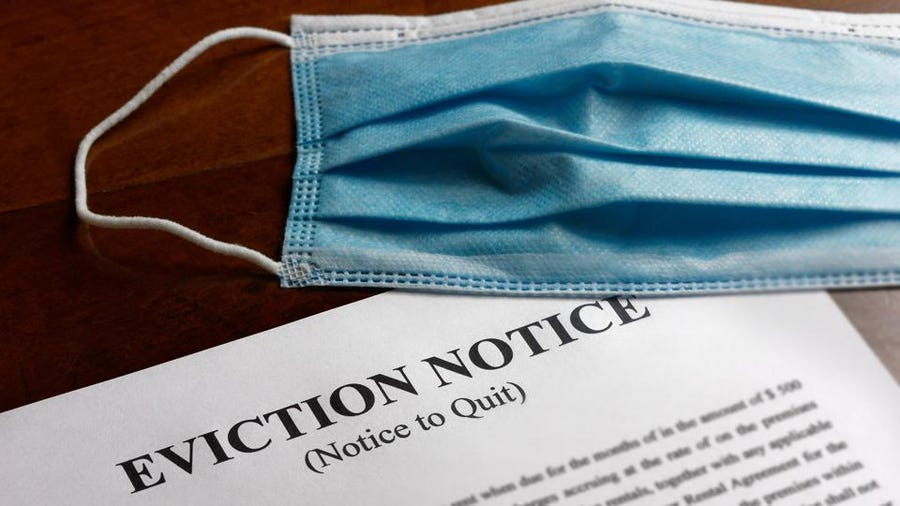

Nobody deserves to wonder if one Supreme Court decision is the difference between keeping their family safely housed or becoming homeless.

The Supreme Court’s recent decision lacks acknowledgment of the ongoing public health crisis and the role housing provides in ensuring our collective health and safety. Both the federal and state governments have an opportunity to do right by those in precarious housing situations right now. MassBudget’s recent release, Piecemeal Progress: An Exploration of Massachusetts Housing Investments, highlights the long-standing relationship between state and federal policies impacting the day-to-day lives and housing options people in the Commonwealth have — or don’t have. The refusal to address the need for measures to keep people in their homes and communities lacks empathy as we’re still trying to recover from a pandemic that has laid bare our need to work toward collective well-being.

In light of last week’s Court decision, the state needs to step up its support for tenants and small landlords. Further, it needs to focus more on long-term solutions such as creating pathways toward homeownership — particularly among those who have been shut out of homeownership opportunities and could be pushed out of their communities by the end of eviction moratorium protections. Piecemeal Progress shows that the state’s approach to housing funding has been disjointed and shortsighted, and we have the chance not to do that again in this moment.

Readers can ask their legislators to support the Housing Equity Bill (H.1434/S.891) to provide people and their families with more protection as we recover from the pandemic. This bill would help to prevent displacement, ensure timely and equitable distribution of rental assistance, and promote racial and economic equity. Learn more from this Homes for All fact sheet.

La-Brina Almeida

State Policy Fellow & Policy Analyst

###