With Legislators debating potential changes to taxes on large estates, it’s important to remember why we have taxes on the transfer of inherited wealth in the first place:

- Fostering Equality of Opportunity — The estate tax is Massachusetts’ only major tax designed to reduce how much individual economic success depends on being born into a wealthy family. Proposals to weaken the estate tax, such as by raising its exemption or excluding higher amounts, would literally be a gift to some of the Commonwealth’s wealthiest families at the expense of everyone else. Paring back the estate tax would cut taxes for the wealthiest, while the state would lose revenue each year that could support schools, public health, libraries, and the other essential needs that give everyone the best chance to succeed.

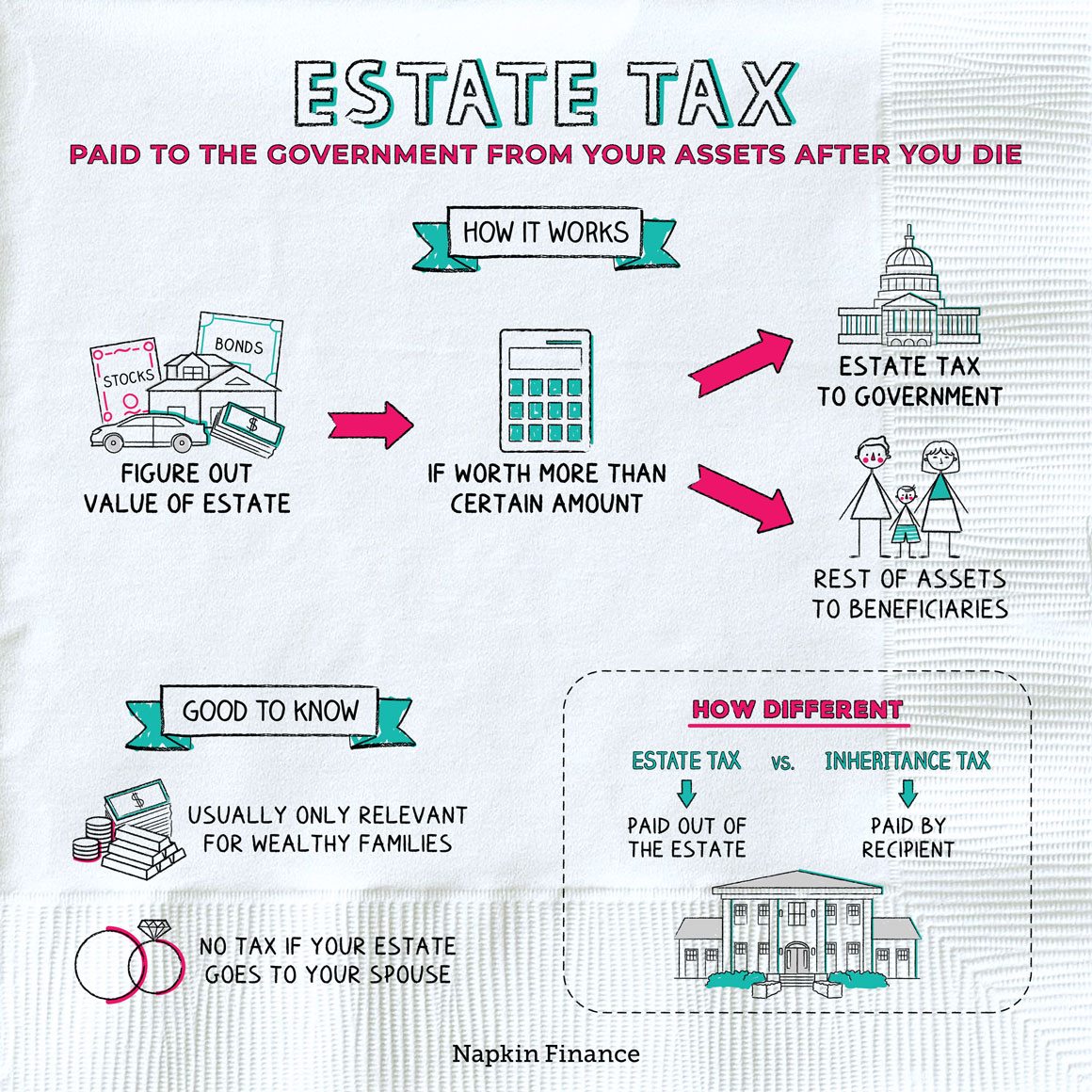

- Countering the worsening wealth gap — Since the 1980s, average wealth in the US has barely grown for the bottom 90 percent of families, but more than doubled for those in the top 10 percent. The top 1 percent now claim about 40 percent of all wealth. Such gaps also compound racial inequality. A typical white family in the US holds eight times the wealth of a typical Black family and five times that of a Latinx family. For the lucky few who receive a large inheritance, estate taxes already include many exceptions. Spouses and some family-owned businesses, for instance, are shielded from the tax.

- Giving back to a support for wealth growth — The estate tax is a way large accumulators of private wealth can give back for their reliance on public investments. The value of stocks, bonds, and other assets depend on schooling that educated a business’ workforce, the roads that brought goods to market, the courts that enforced contracts, the police that protected against theft, and so on.

- Compensating for other ways taxes favor accumulated wealth — Finally, the estate tax addresses some of the ways current law favors people who can afford to hold onto assets rather than sell them to pay for such expenses as retirement and their children’s college. Much of the value of large estates left to heirs is typically stocks, bonds, real estate, and other assets that appreciate over time. When those assets are inherited, their value gets reset. All the capital gains the assets accrued prior to inheritance remain untaxed. The estate tax in part compensates for that.

The pandemic both exposed and worsened economic disparities across Massachusetts. This is the wrong time to weaken the only tax that directly reduces inequality.For more resources on tax policy and tax justice from MassBudget, see https://massbudget.org/research/taxes/