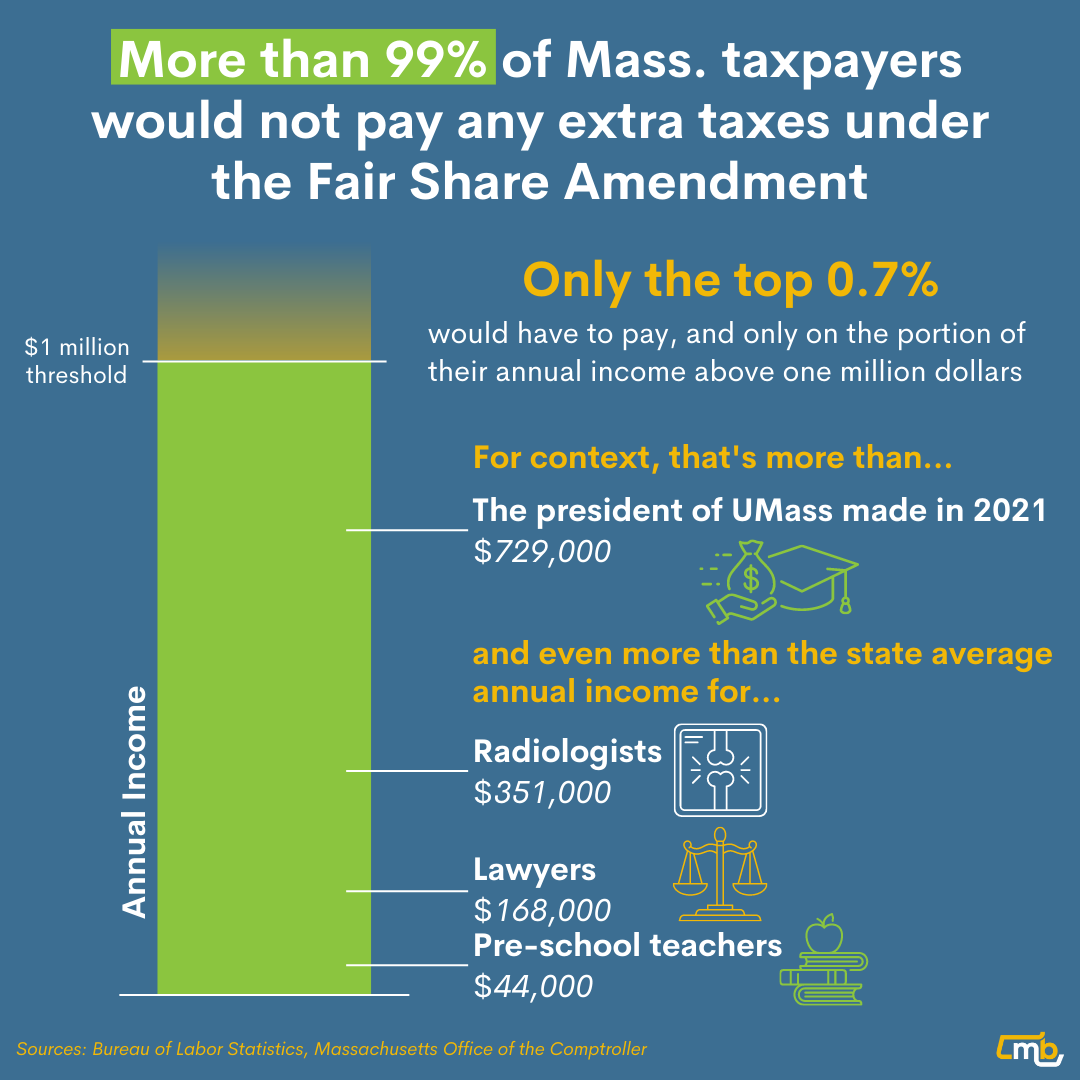

According to the most current federal Bureau of Labor Statistics (BLS) data for Massachusetts (2021), average income for every occupation listed falls far below the $1 million threshold proposed in the Fair Share Amendment. BLS tracks many types of state and federal data related to how workers are faring. Among these data are state-by-state measures of the average income received by workers in over 750 different occupational categories. (Fair Share would create a “millionaire tax” in Massachusetts, which would apply an additional 4 percent tax to the portion of a household’s income above $1 million.)

The highest paid occupations in Massachusetts are radiologists, anesthesiologists, cardiologists and surgeons of every type, all of which have average incomes between about $300,000 and $350,000 a year. Even a married couple with both partners earning the occupational average for these medical specialties would fall far below the Fair Share threshold. Other highly compensated occupations also have average incomes far below $1 million. These include dentists and orthodontists, lawyers, financial managers, computer programmers and database managers, nuclear and aerospace engineers.

The Fair Share Amendment would affect only the very few taxpayers in Massachusetts with taxable incomes above $1 million a year – fewer than 7 in every thousand households. That’s only about 24,000 households out of the more than 3.5 million households that file taxes in Massachusetts each year.