Internal Revenue Service (IRS) data show that Massachusetts has low rates of out-migration among high-income households compared to other states. As a consequence, delivering large tax cuts to these few households to stem a non-existent exodus is misguided. Moreover, the best research shows that state tax levels have little impact on the decisions of high-income households about where to live. At the same time, tax cuts aimed at these few households would sacrifice revenue needed for public investments that address the challenges working families in Massachusetts face. These include the high cost of housing, childcare, and post-secondary education, as well as unreliable transportation systems.

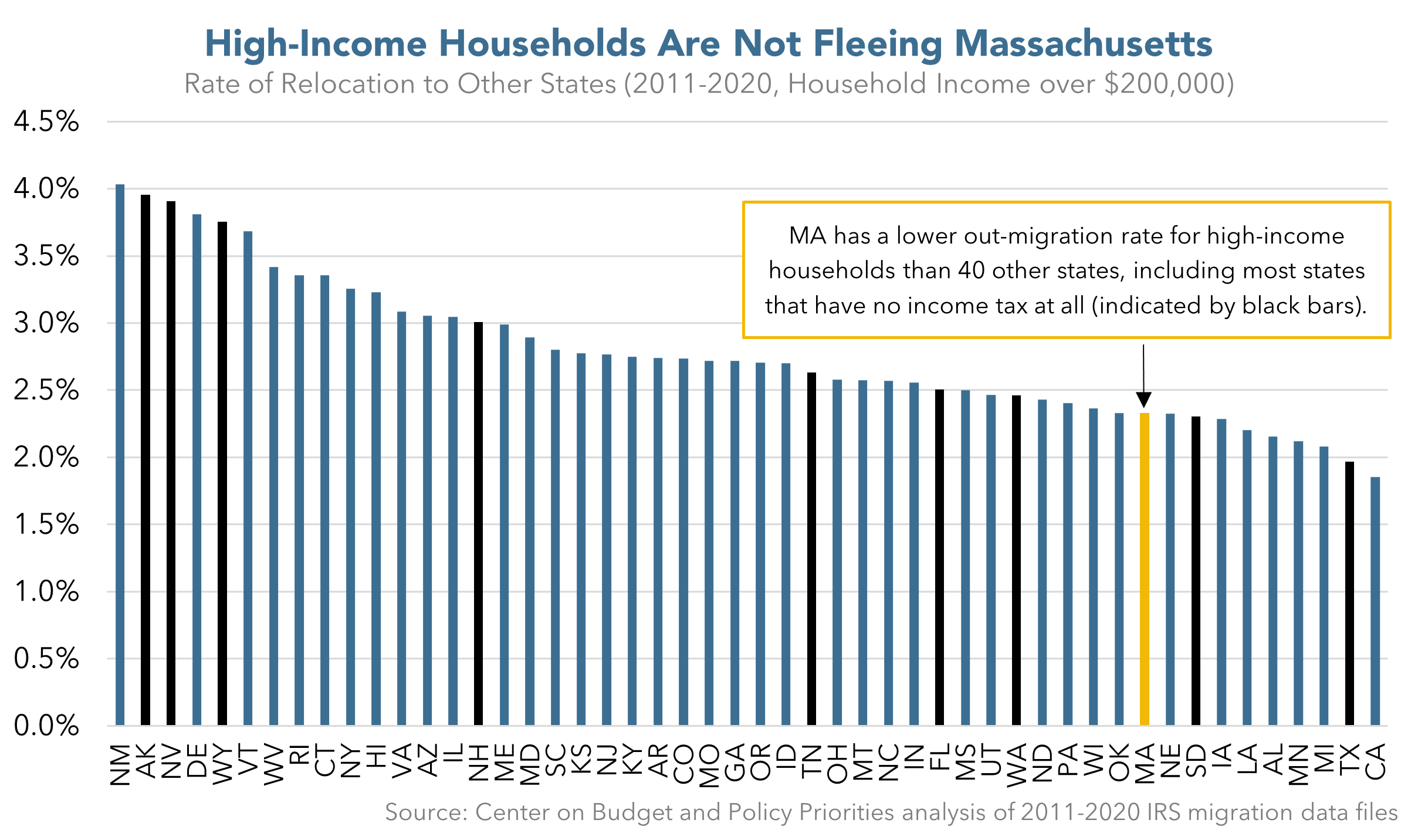

A forthcoming review of IRS data from 2011-2020 (the most current such data available) by the Center on Budget and Policy Priorities shows that Massachusetts has a lower rate of out-migration among high-income households than all but nine other states.1 Notably, the Massachusetts average annual rate of out-migration among high-income households is lower than rates in seven of the nine states that have no income tax at all. (Presenting out-migration data as rates – rather than simply by the total numbers of movers – allows a proper comparison among states, regardless of differences in the states’ overall population sizes. It also makes sense to look directly at out-migration separate from in-migration because there can be different issues driving these decisions.)

This is not a surprising result. The best empirical studies of how high-income households respond to state tax rates arrive at a similar conclusion: for the overwhelming majority of high-income households, decisions on where to live have little to do with state tax levels. The authors of the gold-standard study on high-income relocation, for example, summarize their findings by saying tax-induced relocation occurs “only at the margins of statistical and socioeconomic significance.” Only a very few high-income households move to avoid higher state taxes. Thus, tax cuts for the rich would be a costly and ineffective “solution” to a problem Massachusetts does not have. To the extent that Massachusetts faces challenges with population growth, the solutions lie in addressing the struggles of low- and middle-income households, both those currently living in Massachusetts and those that would like to move here.

In terms of overall net population change – from all causes and including people of all incomes – the most current estimates available from the U.S. Census Bureau show that Massachusetts’ population fell by just under 48,000 between April 2020 and July 2022. This is a decline of just under seven-tenths of one percent out of a total population of some seven million people. Notably, the data indicate that nearly 85 percent of this decline occurred in the fifteen months from April 2020 to July 2021, a period when the onset of the COVID pandemic was affecting death rates and (often-temporary) decisions about where to live during the pandemic. By contrast, in the period from July 2021 to July 2022, Massachusetts saw its net population decline by just 7,700 or one-tenth of one percent.

These net population loss figures are the result of larger flows of people in and out of Massachusetts (as well as births and deaths among Massachusetts residents), the details of which are tracked in the Census data. These flows include the “net domestic out-migration” of some 111,000 Massachusetts residents between April 2020 and July 2022, as well as “net international in-migration” of some 61,000 new residents from overseas.

There always will be some degree of out-migration. People often retire to warmer climates or to the mountains, or move to be near family or for a new career opportunity. In order to achieve a stable or growing population, however, Massachusetts can address the challenges that push people to leave when they otherwise would choose to stay, as well as problems that discourage people in other states and other countries from moving to Massachusetts. An important factor for many families in deciding where to live is affordability – especially for major expenses like housing, childcare, and education. Addressing these challenges will require sustained public investment in things like affordable housing, commuter rail service to new housing markets, affordable high-quality child care, and ready-access to debt-free higher education. Large tax cuts for a few, very high-income and wealthy households will impede the Commonwealth’s ability to make these and other investments in our people and our overall competitveness. By contrast, targeted and well-funded state investments will help retain and attract the many people who want to make Massachusetts the place where they learn and work, start and grow a business, raise a family and eventually retire.

1 Forthcoming Center on Budget and Policy Priorities analysis of Internal Revenue Service (IRS) Gross Migration files, 2011-2012 through 2019-2020. High-income households in this analysis are those with federal Adjusted Gross Income of $200,000 or more. This is the highest income grouping provided in the IRS data. Due to a significant change in the IRS’ methodology, data prior to 2011 are not comparable with data from 2011 and more recent years.

The out-migration rate is equal to the number of high-income “outflow returns” (i.e., tax returns that were listed in the state at the beginning of the year but that departed from the state at some point during the year) divided by the total number of high-income tax returns present in the state at the beginning of the year.