National data show that the U.S. has very large wealth disparities among racial groups. Data for the Greater Boston Metro Region indicate that racial wealth disparities are still more extreme in Massachusetts. Even in comparison to other, very large racial disparities – such as gaps for life expectancy and income – the racial wealth gap is especially extreme.

Over the last year, the House, the Senate, and both Governor Baker and Governor Healey all have proposed large estate tax cuts. The Massachusetts estate tax is the only tax the Commonwealth levies on wealth. It affects only very large estates – those having over $1 million in taxable value – and does so only once, at the time of death.

Inheriting money from an estate is unusual. Over 70 percent of Americans expect to see no inheritance at all – much less an inheritance exceeding $1 million. Intergenerational transfers of wealth differ markedly among racial groups. Seventy percent of U.S. white households expect to receive no inheritance, according to new research from Boston Indicators and Brandeis University. For Black and Hispanic households, the percentage expecting no inheritance jumps to 90 percent and 92 percent, respectively.

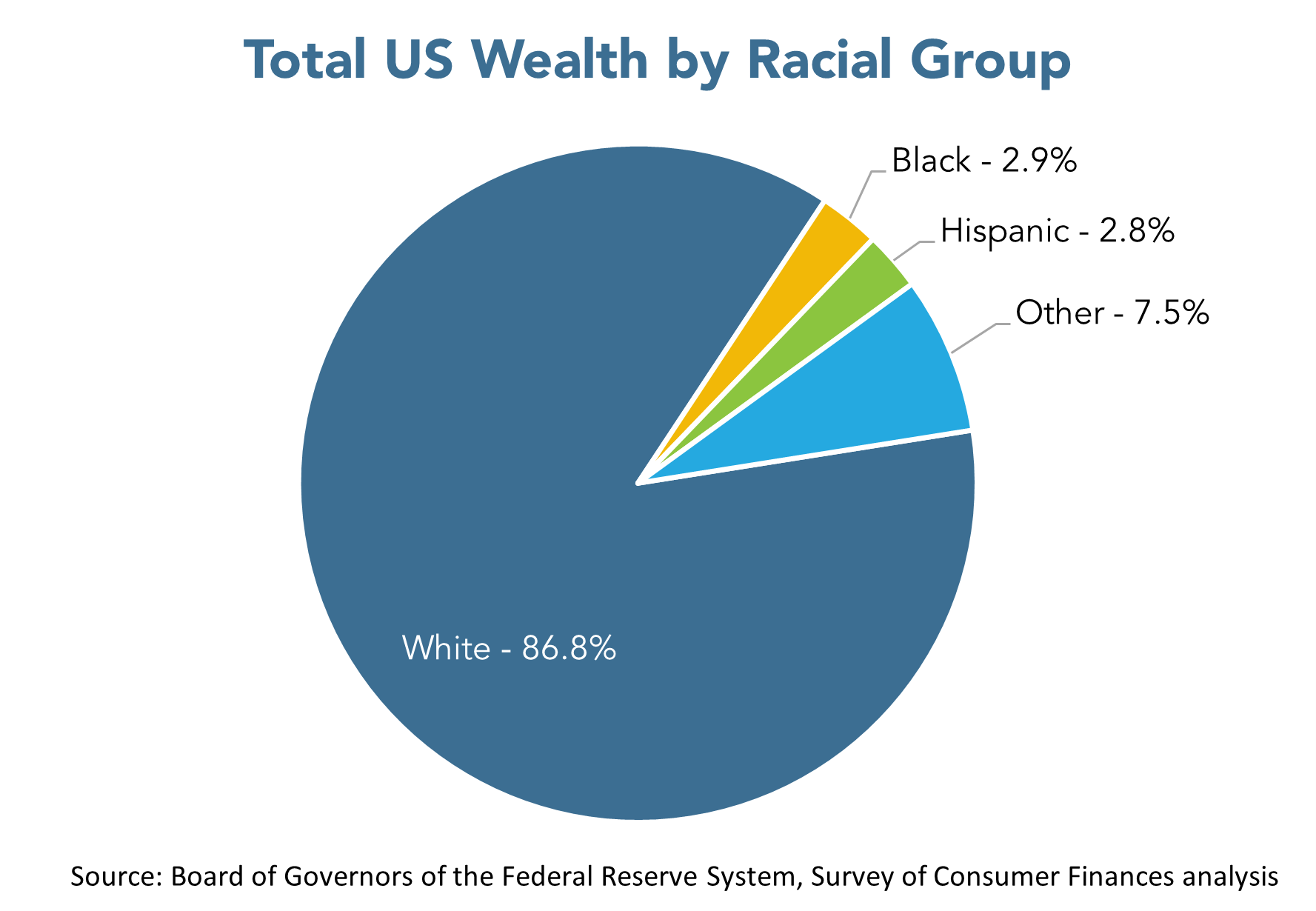

Data from a Federal Reserve report point to one major factor driving these very different racial outcomes: the overwhelming majority of national wealth is held by white households. (See chart.)

The Federal Reserve study found that U.S. white households hold almost 87 percent of total national wealth, despite representing only 68 percent of the population. Black and Hispanic households meanwhile hold less than three percent of wealth each, while comprising 15.6 percent and 10.9 percent of the population, respectively.

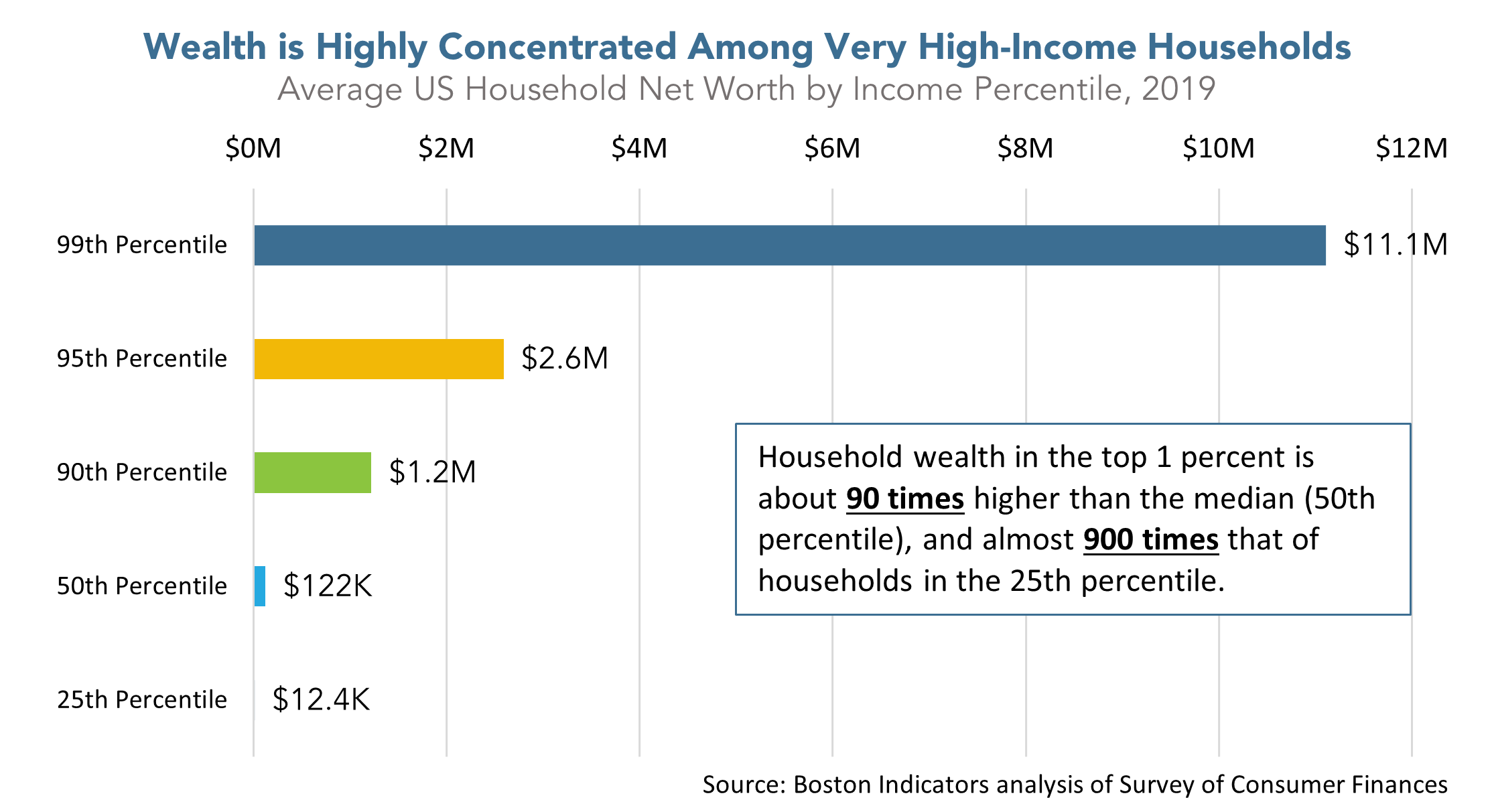

Not only is wealth highly concentrated by race, it also is highly concentrated by income – meaning few people in any racial group benefit from estate tax cuts. While accumulated wealth and annual income are not the same thing, it is the few households with very high incomes that typically have high wealth. The new research from Boston Indicators and Brandeis University (which looks at the Federal Reserve’s nationwide Survey of Consumer Finances data) reveals that the top 1 percent of households by income have average wealth of $11.1 million, those in the 95th percentile have $2.6 million, and those in the 90th percentile have $1.2 million. Meanwhile, U.S. households at the 50th percentile by income – those in the middle of the income distribution – have average wealth of $122,000. Households in the 25th percentile have just $12,400. (See chart below.) In other words, on average, the top 1 percent of households have over 90 times the wealth of households in the 50th income percentile, and almost 900 times the wealth of households in the 25th income percentile.

Disparities in wealth are so big and persistent in large part because they grow over time, as concentrations of wealth get passed from one generation to the next. Estate taxes play an important role in taxing large concentrations of wealth that otherwise may go untaxed. If lawmakers cut the Massachusetts estate tax, it is a small number of high-income, white households that will receive the overwhelming share of the benefits. People of color and low- and moderate-income households will receive very little benefit from such cuts.

Bad as this outcome would be for racial and economic equity, the full picture is significantly worse. The loss of state revenue resulting from estate tax cuts would reduce the Commonwealth’s ability to make the kinds of investments that, over time, can move us toward greater wealth equity. These include investments in affordable, high-quality education, housing, transportation and more. Estate tax cuts therefore make the problem of wealth inequality worse, even as the cuts undermine our ability to address the problem.

The larger the overall cost of any estate tax cut, the more racially (and economically) inequitable the impacts will be. Similarly, the more an estate tax cut is structured to deliver its largest benefits to the biggest estates, the worse will be its impact on wealth inequality.

While any cut to the estate tax is detrimental, structuring estate tax cuts to reduce the overall revenue loss and focus benefits on smaller estates will produce a less regressive outcome.