Massachusetts currently has the highest per capita income of any state, but the Commonwealth lags many states when it comes to using those resources to support funding for education, health, human services, transportation and the like. Massachusetts is even below the national average.

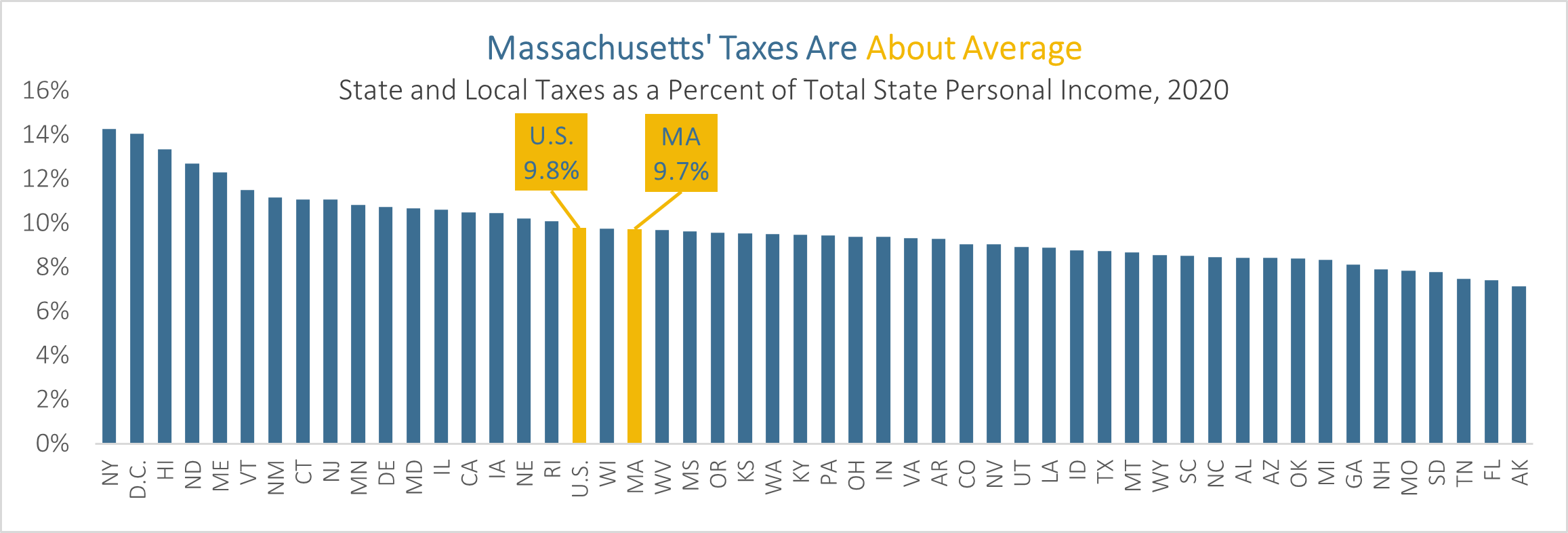

Total collected state and local taxes in Massachusetts make up only 9.7 percent of the total size of the state’s economy (as measured by total state personal income.) Massachusetts is lower than Maine, Vermont, Rhode Island, Connecticut, and New York. Massachusetts is 19th among the states and District of Columbia (see chart). This is a useful way to compare total tax collections across states because we can compare large states with small states and compare states to a national average. We can also compare states from year to year.

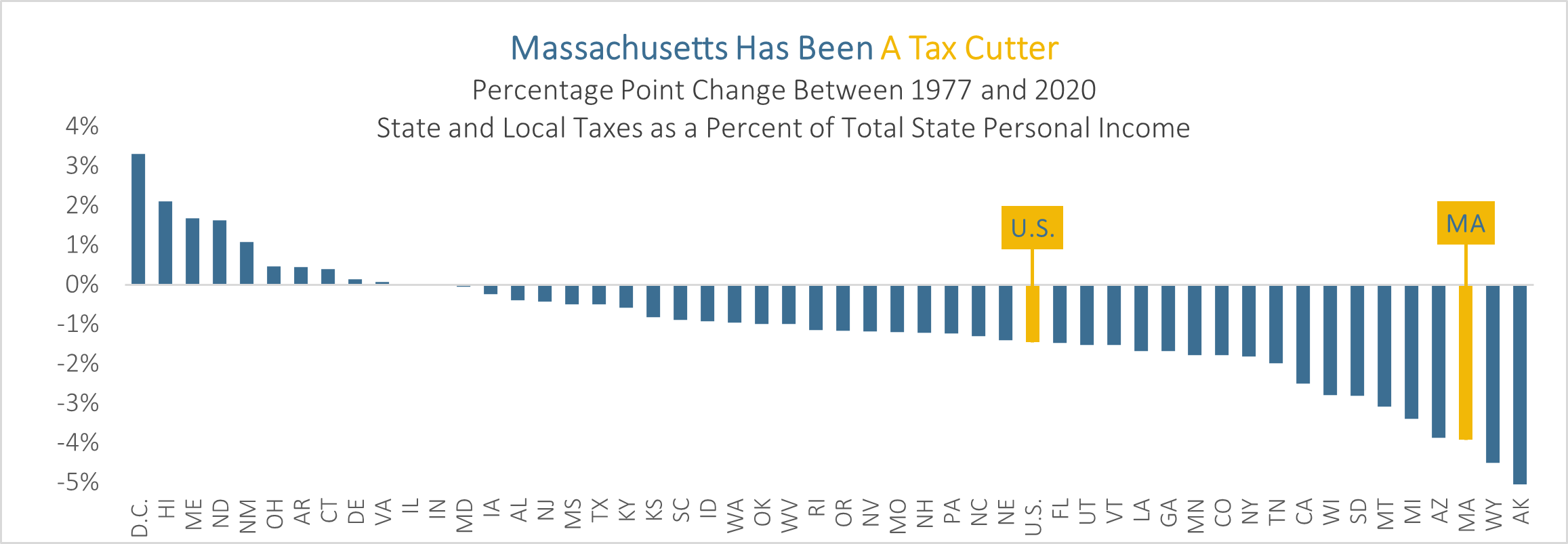

It’s worth noting that Massachusetts is anything but average when it comes to cutting taxes.

With the approval of local property tax cuts in 1980 (Proposition 2 ½) and significant cuts to the income tax in the late 1990s, Massachusetts was among the national leaders in cutting taxes. Between 1977 and 2020, only Alaska and Wyoming have cut taxes more than Massachusetts (see chart.)

Source: U.S. Census Bureau (tax data); U.S. Bureau of Economic Analysis (income data). Alaska’s percentage point change as percent of total state personal income (11%) exceeds scale of the graph.