Currently, the Massachusetts tax system is upside down: the highest income households pay a significantly smaller share of their income toward state and local taxes than the rest of us do. A “millionaire tax” would help turn our tax system right-side up.

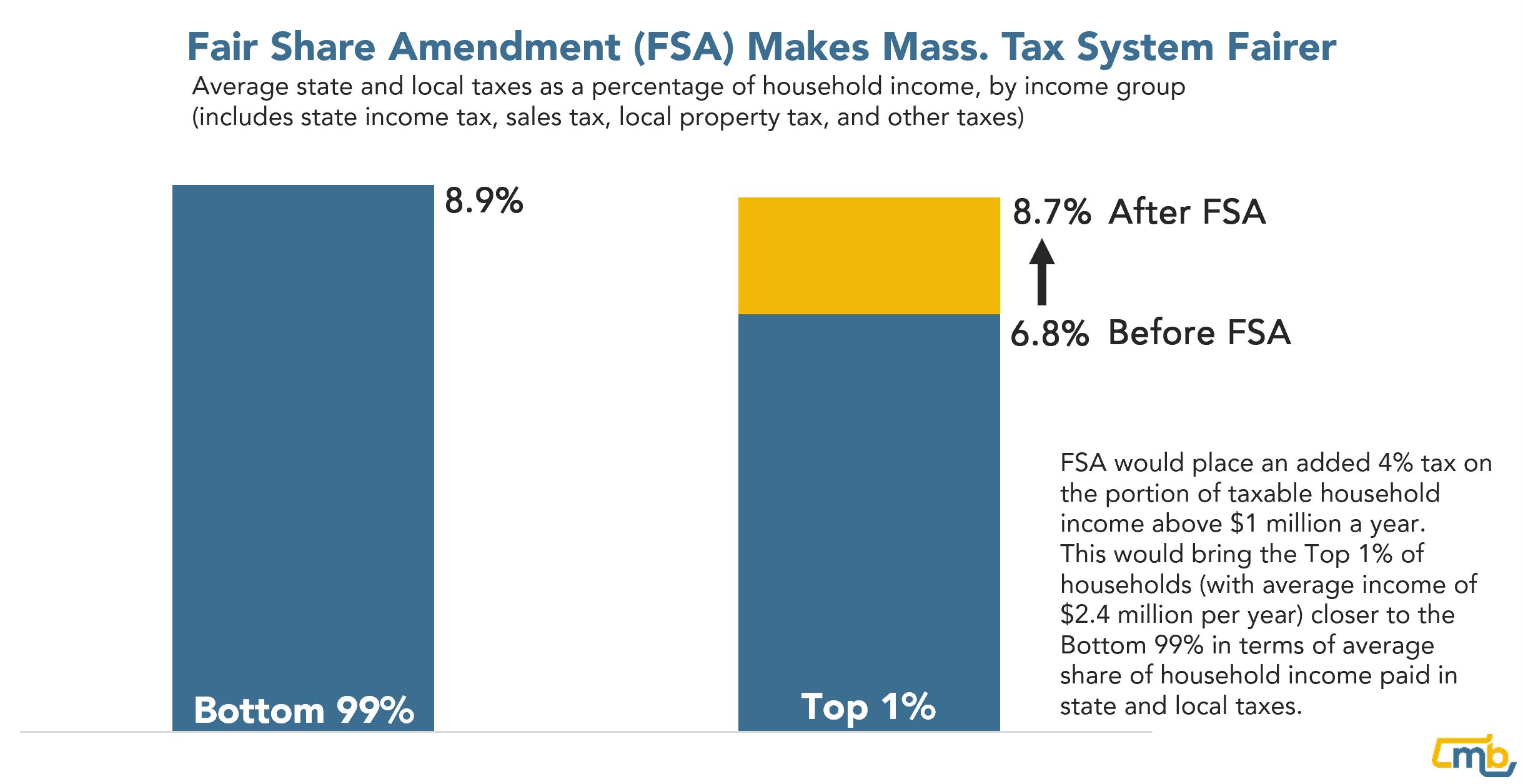

The “Fair Share Amendment” would create a millionaire tax in Massachusetts. It would apply an additional 4 percent tax to the portion of a household’s income above $1 million. With such a tax in place, the top 1% of households (whose average income is $2.4 million a year) would pay a share of their income toward state and local taxes that is closer to the share of household income that the rest of us pay (see chart, below).

As the chart above shows, the top 1% of households pay an average of 6.8 percent of their income toward state and local taxes. With the Fair Share Amendment in place, the top 1% instead would pay an average of 8.7 percent. This is closer to the average 8.9 percent share of income paid by the bottom 99% of households.

It is important to underscore that a millionaire tax would affect only the very few taxpayers in Massachusetts with taxable incomes above $1 million a year – fewer than 7 in every thousand households. Notably, these are the same households that benefit from billions of dollars each year in state and federal tax breaks, and which, as a group, have prospered during the pandemic.

Working together, the people of Massachusetts can create a better Commonwealth. We can modernize our schools and state colleges. We can repair and upgrade our crumbling roads, bridges, and public transit systems. We can provide affordable, high-quality childcare and put vocational training and higher education within reach of those who want it. To achieve this vision, we will need to collect substantial, additional tax revenue – and do that in a way that’s fair. A millionaire tax is one example of a policy that can make our tax system fairer and help deliver broadly shared economic prosperity and racial justice.