Over the last year, the House, the Senate, and both Governor Baker and Governor Healey all have proposed large estate tax cuts. The Massachusetts estate tax is the only tax the Commonwealth levies on wealth. It affects only very large estates – the several thousand estates each year with taxable values above $1 million – and does so only once, at the time of death. Given the extreme concentration of wealth by race and income in the U.S and Massachusetts, the benefits of any cuts to our state estate tax would go overwhelmingly to a small number of very high-income, white households. Other racial and income groups would receive very little of the benefit.

Bad as this outcome would be for racial and economic equity, the full picture is significantly worse. The resulting loss of state revenue would reduce the Commonwealth’s ability to make crucial investments that, over time, can move us toward wealth equity. Estate tax cuts therefore make the problems of racial and economic inequality worse, while simultaneously undermining our ability to address these problems.

Importantly, the larger the total cost of any estate tax cut, the more inequitable its impact will be. So too, the more an estate tax cut concentrates its largest benefits on the biggest estates, the worse will be its impact. Limiting the overall cost of any proposal and focusing the benefits on smaller estates will reduce the unavoidably regressive results of cuts to the current Massachusetts estate tax structure.

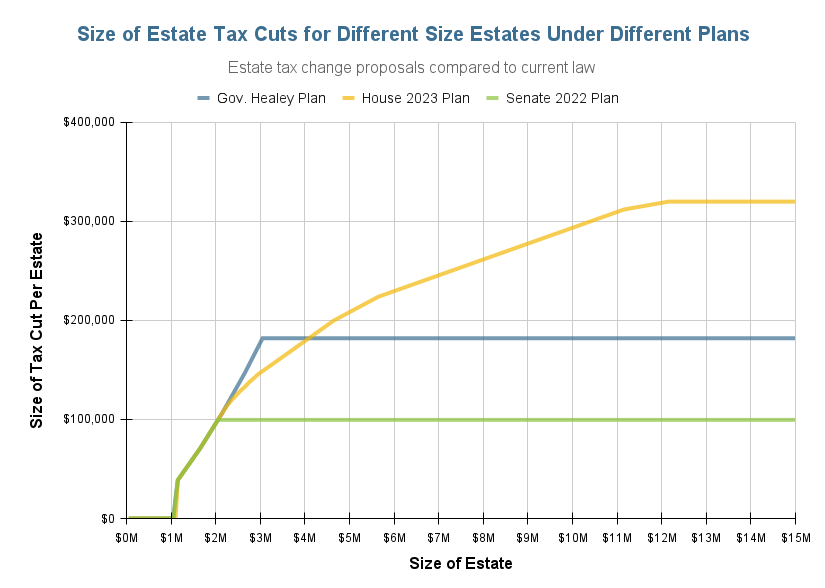

Governor Healey’s estate tax cut proposal would reduce revenue by $275 million annually and deliver its largest tax break ($182,000 per estate) to estates valued at $3 million and above. The House proposal is somewhat smaller (a $231 million annual revenue loss) but would deliver its biggest tax break ($320,000 per estate) to estates valued at $12 million and above. A Senate plan discussed as part of the July 2022 economic development bill was estimated to cost $185 million annually and would provide a maximum tax cut of $99,600 to estates valued at $2 million and larger. This 2022 Senate plan would both cost less than the Governor or House plans and would focus more of its benefits on smaller estates. Consequently, the 2022 Senate plan would worsen racial and economic inequality less than the House or Governor’s proposals would.

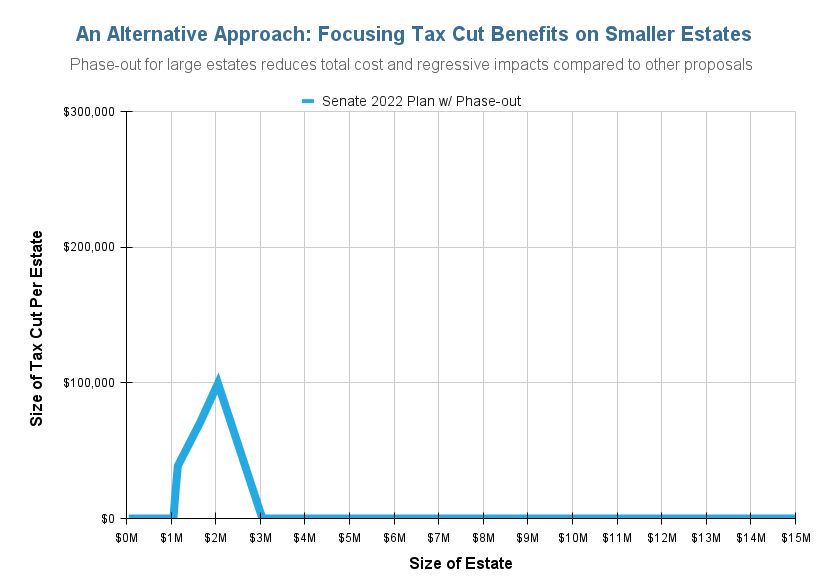

It is possible to limit the overall cost of any of these proposals significantly – and focus the benefits on smaller estates – by phasing out tax cuts for larger estates. Phase outs would reduce, though by no means eliminate, the racial and economic inequities that cuts to the estate tax would generate.

The chart below shows what this approach could look like if, for example, the tax credit proposed in the 2022 Senate plan were, after reaching its maximum value, phased out gradually between $2 million and $3 million of estate value. The Massachusetts Department of Revenue (DOR) has not released sufficiently detailed information about the size and number of taxable estates to allow for accurate estimates of the potential cost savings that such a phase out would deliver. Rough estimates based on the available DOR data suggest that such a phase out would reduce the overall annual cost of the 2022 Senate plan by several tens of millions of dollars. Simple phase out structures could be designed for any estate tax cut proposal.