While the Massachusetts Legislature debates two versions of expanded tax credits to improve affordability for families, new census data dramatically show what a difference these credits make to reduce poverty, especially for children.

Data released by the Census Bureau last week illustrate that refundable tax credits, like the Earned Income Tax Credit and Child Tax Credit, reduce poverty. When federal pandemic-related expansions in credits to families expired, child poverty soared nationwide. This highlights the need for our Commonwealth to help fill the gap with expanded refundable state tax credits.

The most complete census measure of poverty, the Supplemental Poverty Measure (SPM), increased from 7.8 percent in 2021 to 12.4 percent in 2022 nationwide. The increase in poverty was larger for BIPOC communities, including BIPOC children.1 Massachusetts families have been hit hard with the expiration of expanded federal programs, notably the lapse of an expanded federal child tax credit at the end of 2021. The Census Bureau estimates that over 148,000 Massachusetts children lived in poverty in 2022.2

The Massachusetts Legislature is debating two competing proposals to create the Child and Family Tax Credit (CFTC), a refundable tax credit for families with children and adult dependents. The new CFTC would combine two existing smaller refundable credits, which families must currently choose between, and remove the cap on the number of eligible dependents. The more generous of the two proposals would ramp up the size of the credit to $600 per dependent over three years and index the credit amount to inflation, ensuring the credit retains its value into the future. Choosing this more generous option will provide more adequate relief as several other states have done this year.

Differing Poverty Measures Point to the Cause of Increased Poverty

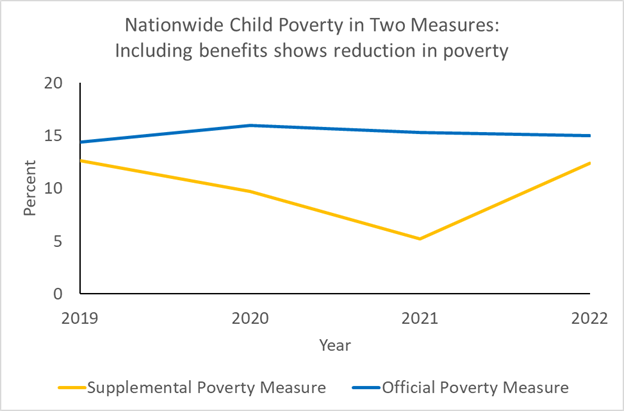

The differences between alternative measures of poverty help to pinpoint the cause of growing poverty. The Census Bureau uses two different key metrics to measure poverty, the Official Poverty Measure (OPM) and the Supplemental Poverty Measure (SPM). These metrics differ in some important ways. The OPM is based on cash resources and does not account for expenses and government benefits like refundable tax credits and Medicaid. Changes in those programs are not reflected in this measure. In contrast, the SPM accounts for expenses and government benefits, therefore giving a more complete picture of poverty in the United States. The SPM also accounts for regional differences in expenses, which is important given that Massachusetts has a high cost of living.

Key for our purposes here, the difference between OPM and SPM helps measure the impact of government benefits like refundable child tax credits because they only show up in the SPM. The dip in SPM, but not OPM, in 2021 was due in part to expanded federal government benefits that year as part of pandemic aid. When the more generous benefits expired in 2022, SPM increased while OPM remained relatively unchanged.

Endnotes

1 See Figure 5, page 8 and Table B2. Shrider, E.A., & Creamer, J. (2023, September). Poverty in the United States: 2022 (P60-280). U.S. Government Publishing Office, Washington, DC. Retrieved from https://www.census.gov/content/dam/Census/library/publications/2023/demo/p60-280.pdf

2 2022 1-Year American Community Survey (ACS) estimate is between 137,997 and 158,647