Taxes

Recent

ALL TAXES REPORTS

With Rainy Day Fund Filling Up Fast, It’s Time to Invest in Community Needs

The state’s rainy day fund is fast approaching its capped “allowable balance.” It could exceed the cap at the end of Fiscal Year 2024. With so many unmet needs for revenue throughout the Commonwealth, lawmakers should ensure the fund’s value remains below the cap.

Read More →

Preventing High-Income Tax Avoidance to Protect Education and Transportation

Problems with potential high-income tax avoidance can be solved by following many other states that require that taxpayers file their state income taxes with the same status they use on their federal taxes.

Read More →

Memo to Governor Healey on Ways to Ensure Effective Implementation of the Fair Share Amendment

Marie-Frances Rivera , Phineas Baxandall

January 5, 2023

Budget Resources Education Taxes Transportation

As Massachusetts voters have amended the state constitution to include a 4 percent surtax on taxable income over $1 million, MassBudget would like to offer policy suggestions to assist the Commonwealth in protecting this revenue and ensuring that it is directed to education and transportation, as specified in the amendment.

Read More →

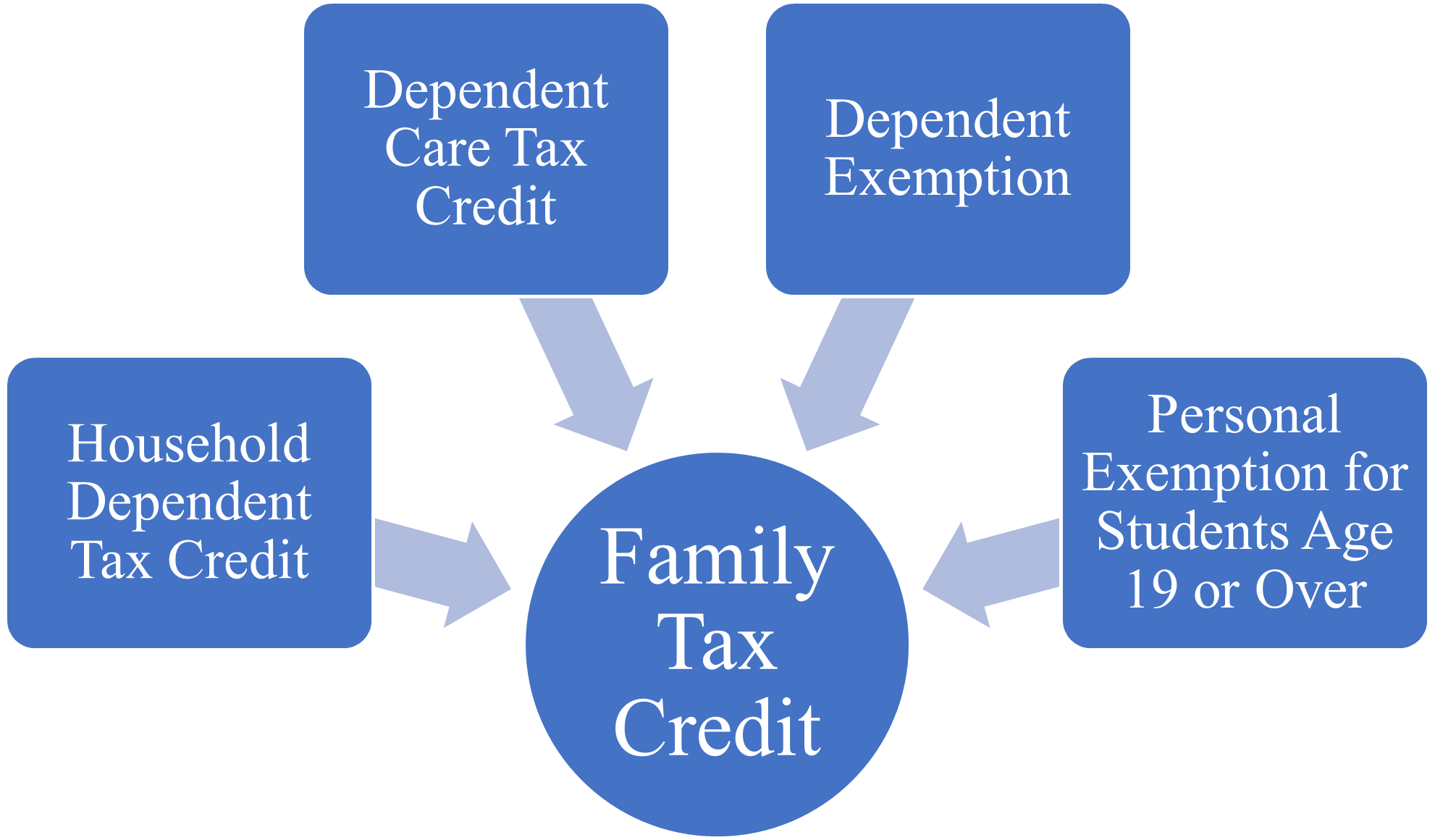

Letter to Governor-elect Healey and Lieutenant Governor-elect Driscoll on a Family Tax Credit

A letter to Governor-elect Healey and Lieutenant Governor-elect Driscoll on a consolidating different family tax supports into one simpler, fully refundable Family Tax Credit.

Read More →

“Excess” as Mirage: How the 62F Tax Cap Distorts Our View of Massachusetts Tax Revenue

The 1986 tax cap law, also known as “62F,” artificially limits the amount of tax revenue available to address priorities like affordable, quality childcare, safer public transportation, and affordable housing. Moreover, there are flaws in the 62F law and its underlying formula. 62F tells a story about revenue in Massachusetts, but it is misleading.

Read More →

Fair Share Would Increase Total Tax Rates Only Modestly for Most with Incomes Over $1 Million

Because the Fair Share surtax would apply a 4 percent surtax only to the portion of a household’s taxable income above $1 million, the total tax rate of the vast majority of Fair Share-affected filers would be much lower than the top rate of 9 percent.

Read More →

The Fair Share Millionaire Tax and Home Sales: What 2021 Data Shows

Based on industry data from the Warren Group on home sales in Massachusetts, previous analysis has shown how rare it is that a sale might generate taxable capital gains of $1 million or more. But what does the data say about home sales that might have created taxable income over $1 million in 2021?

Read More →

The Myth of the One-Year Middle Class Millionaire

“One-time” occurrences of $1 million income are relatively rare overall, and in fact much rarer for the middle-class. It is far more common for tax filers who exceed $1 million in annual income to do so year over year. An examination of available data suggests that when a middle-class taxpayer sells their small business or home, they would be highly unlikely to have a taxable income over $1 million, the point at which additional income would be subject to the new proposed tax under ballot Question 1 (Fair Share).

Read More →

Very Few Small Businesses Sell for More Than $1 Million; Even Fewer Would be Subject to Fair Share

Will small business owners be subject to the proposed Fair Share tax if and when they sell their businesses? Very unlikely.

Read More →

Even Among Retirees with High Wealth, Few Will Pay the Fair Share Tax

The proposed “millionaire tax” only applies to the portion of a taxpayer’s annual taxable income over $1 million. For many retirees, much of their income is not subject to the income tax and therefore not subject to an additional tax on income over $1 million. And wealth, such as personal savings and investments, are not subject to the income tax. Even when wealth is sold to generate additional financial gains, this income is often tax-exempt or shielded by widely used deductions.

Read More →

Fundamentally Flawed: 62F Formula Overstates “Excess” by $1.4 Billion

The $2.9 billion estimate of 62F "excess tax collections" recently certified by the State Auditor overstates these net Fiscal Year (FY) 2022 collections by $1.4 billion. The problem is not that the Auditor miscalculated but that the calculation as stipulated in the 62F statute fails to account for situations where taxes are received by the Commonwealth in one fiscal year, but corresponding, offsetting tax credits are not applied until the following fiscal year. This is one of the many fundamental flaws in the 1986 tax cap law (referred to as "62F").

Read More →

Where Might Home Sales Be Subject to the Fair Share Amendment? A Local Breakdown

In the majority of Massachusetts cities and towns, no homes sold for a net gain of $1 million or more, meaning they wouldn't be subject to any additional taxes under the Fair Share Amendment.

Read More →

62F Credits Benefit the Rich

The “tax cap law,” or what is known as “62F,” sets an artificial limit on how much tax revenue Massachusetts can collect, regardless of the current needs of the Commonwealth. This law in effect transfers to higher income households tax revenue paid by lower income households and does nothing to improve racial or economic equity in our state.

Read More →

Interactive Map: Most Home Sales Will Not Likely Lead to Fair Share Tax Payments

Even in Massachusetts’ hot housing market with many homes selling for over $1 million, the vast majority of all home sales will not subject the home sellers to a proposed “millionaire’s tax.”

Read More →

Fair Share Facts: New Report Tackles “Millionaires Tax” Claims

Contact: Reginauld Williams, 617-426-1228×102, rwilliams@massbudget.org For Immediate Release: Thursday September 15, 2022 BOSTON – With just over 50 days left until the general election here in the Commonwealth, the latest report from the Massachusetts Budget and Policy Center (MassBudget) evaluates the best research on the impact of the Fair Share Amendment, also known as the “Millionaires Tax,” and its impact on the Bay State’s future. This November, Massachusetts voters will decide whether to approve an additional 4 percent tax on the portion of a tax filer’s income above $1 million. “We can’t allow misconceptions about taxing the very wealthy among us ...

Read More →